24 Feb Liquid Funds: The Art of Managing Idle Cash Better Than FDs or Savings Accounts

Many of us keep a significant amount of money in our savings accounts or fixed deposits (FDs) for emergencies, upcoming expenses, or short-term goals. But is that the best way to manage cash? Enter Liquid Funds—a smart investment option that offers better returns than savings accounts, more flexibility than FDs, and a tax advantage by deferring taxes until withdrawal. At Wealthsane, we help individuals and businesses make better investment choices so their money works efficiently without unnecessary risks.

What Are Liquid Funds?

Liquid funds are a type of mutual fund that invests in short-term, low-risk financial instruments like treasury bills, commercial papers, and certificates of deposit. They provide stability, easy access to money, and better returns than a regular savings account.

The Ideal Use Cases for Liquid Funds

- Emergency Fund Parking

- Instead of keeping all emergency funds in a savings account earning ~3-4% interest, liquid funds offer returns of ~6-7% while ensuring easy access to money.

- Withdrawals are processed within 24 hours, making it a great alternative to traditional emergency funds.

- Short-Term Goals (0-12 months)

- Planning to buy a car in 6 months? Or pay your insurance premium next quarter? Instead of letting money sit idle in a bank account, invest it in a liquid fund to earn better returns.

- Unlike FDs, there are no penalties for early withdrawals.

- Managing Business Cash Flow

- Business owners often have extra cash from sales and invoices. Instead of keeping it in a current account (which earns zero interest), they can invest in liquid funds and withdraw as needed.

- A simple way to keep working capital available while earning returns.

- Tax Deferral Advantage Over FDs

- Interest from FDs is taxed every year as per income slab, while liquid fund gains are taxed only at the time of withdrawal, helping defer tax liability.

- This tax deferral can help high-income earners get better post-tax returns than FDs.

- Salary Parking for Professionals & Freelancers

- Freelancers or consultants with irregular income can use liquid funds to park their earnings and withdraw when needed.

- Helps maintain liquidity while earning better returns than a savings account.

- Parking Funds Before Big Investments

- Planning to invest in equity mutual funds or real estate but waiting for the right opportunity? Instead of keeping money idle, park it in a liquid fund.

- This ensures your capital is not only safe but also earning returns while you wait.

How Liquid Funds Helped Ravi

Ravi, a 35-year-old IT professional, received a bonus of ₹5 lakh. He planned to use this money for a home down payment in six months. Instead of keeping it in a savings account, which would earn him only ~3% interest, he parked it in a liquid fund. In six months, his investment grew by approximately ₹15,000, giving him extra money for other expenses while maintaining full liquidity. Had he chosen an FD, he would have faced penalties for early withdrawal. Ravi was able to withdraw his money seamlessly within 24 hours when he finalized his home deal.

At Wealthsane, we guide clients like Ravi in making smart investment choices, ensuring their idle cash earns better returns while remaining easily accessible.

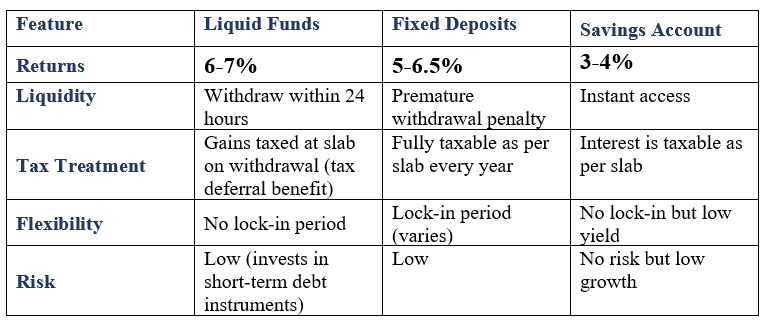

Advantages of Liquid Funds Over Savings Accounts & FDs

When Should You Not Use Liquid Funds?

- If your money is needed within 1-2 days, a savings account might be better for immediate access.

- If you are looking for guaranteed returns, FDs provide fixed interest rates, whereas liquid fund returns can change slightly.

- For long-term goals beyond 3 years, equity mutual funds provide better growth potential.

Conclusion

Liquid funds offer the perfect balance between safety, liquidity, and returns. Whether you are a salaried professional, freelancer, business owner, or investor, managing idle cash smartly with liquid funds can help you grow your wealth effortlessly.

At Wealthsane, we specialize in helping our clients make strategic investment choices, ensuring they optimize their cash while minimizing tax liabilities. Instead of letting your money sit idle in a savings account or locking it up in an FD, consider liquid funds as a smarter way to manage short-term cash!

We are AMFI Registered Mutual Funds Distributors & Top Tax Consultants based out of Thane